2024 Irs Schedule A Form 1040 – The deductions are documented on Internal Revenue Service Schedule C, which is filed with the small business owner’s Form 1040. Workers’ compensation premiums are only deductible when they are . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Irs Schedule A Form 1040

Source : www.investopedia.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

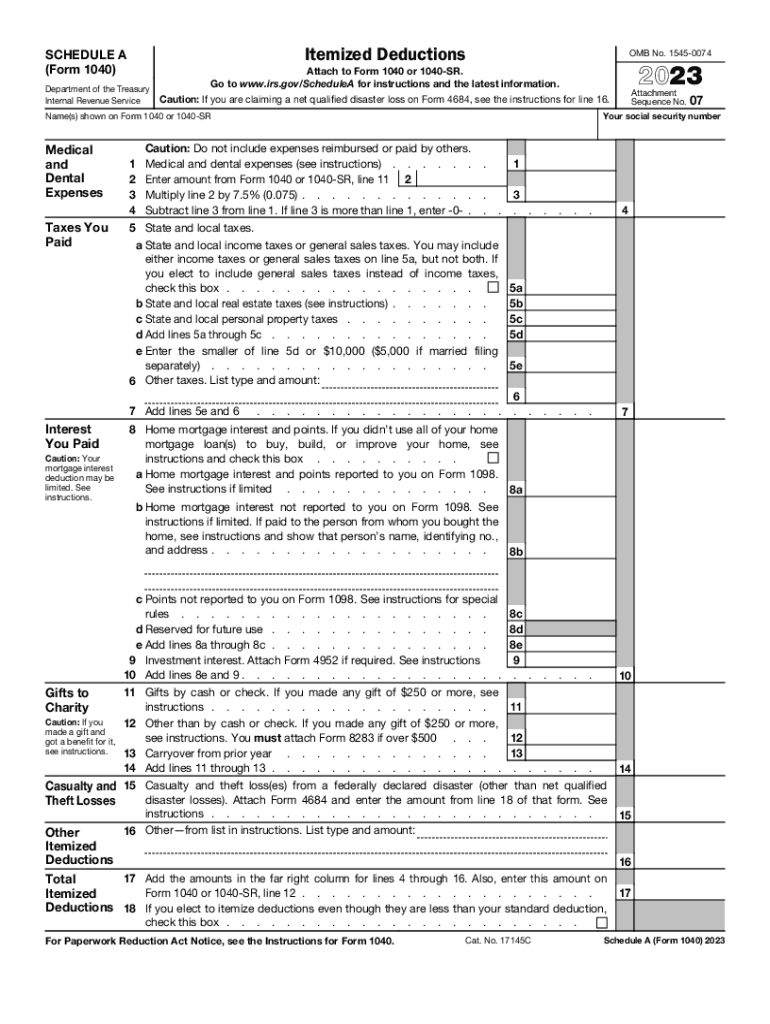

Source : www.kxan.com2023 Form IRS 1040 Schedule A Fill Online, Printable, Fillable

Source : irs-form-1040-schedule-a.pdffiller.com1040 (2023) | Internal Revenue Service

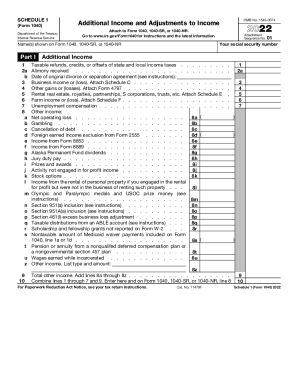

Source : www.irs.govIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.za2023 Form IRS 1040 Schedule SE Fill Online, Printable, Fillable

Source : schedule-se-form-1040.pdffiller.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.org1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Irs Schedule A Form 1040 All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions that are not listed on the standard Form 1040. It includes sections for reporting .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)