2024 Schedule 8812 – In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was . A bipartisan bill that just made its way through the House would expand the child tax service. Here’s what to know. .

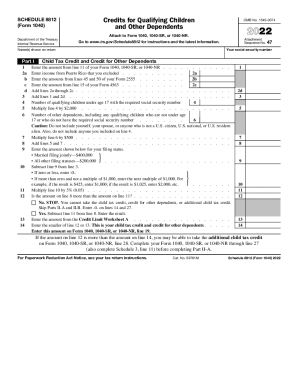

2024 Schedule 8812

Source : turbotax.intuit.comIRS 1040 Schedule 8812 2022 2024 Fill and Sign Printable

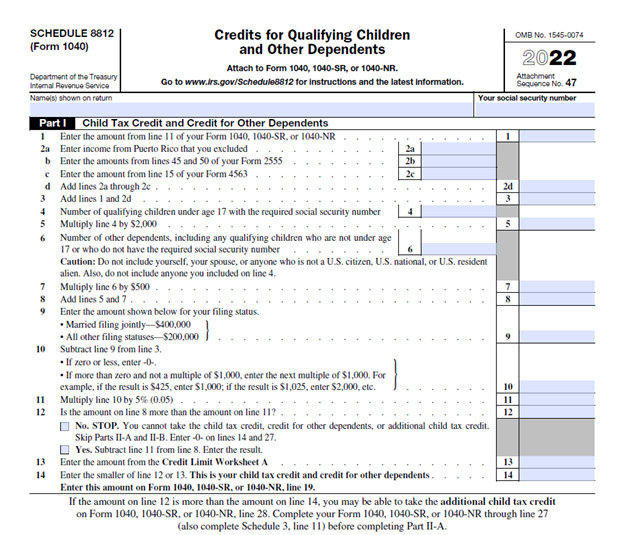

Source : www.uslegalforms.comUnderstanding IRS Form 8812 for Child Tax Credit in 2023 and 2024

Source : fox59.com2023 Form IRS 1040 Schedule 8812 Fill Online, Printable

Source : 1040a-child-tax-credit.pdffiller.comHow to Complete IRS Schedule 8812

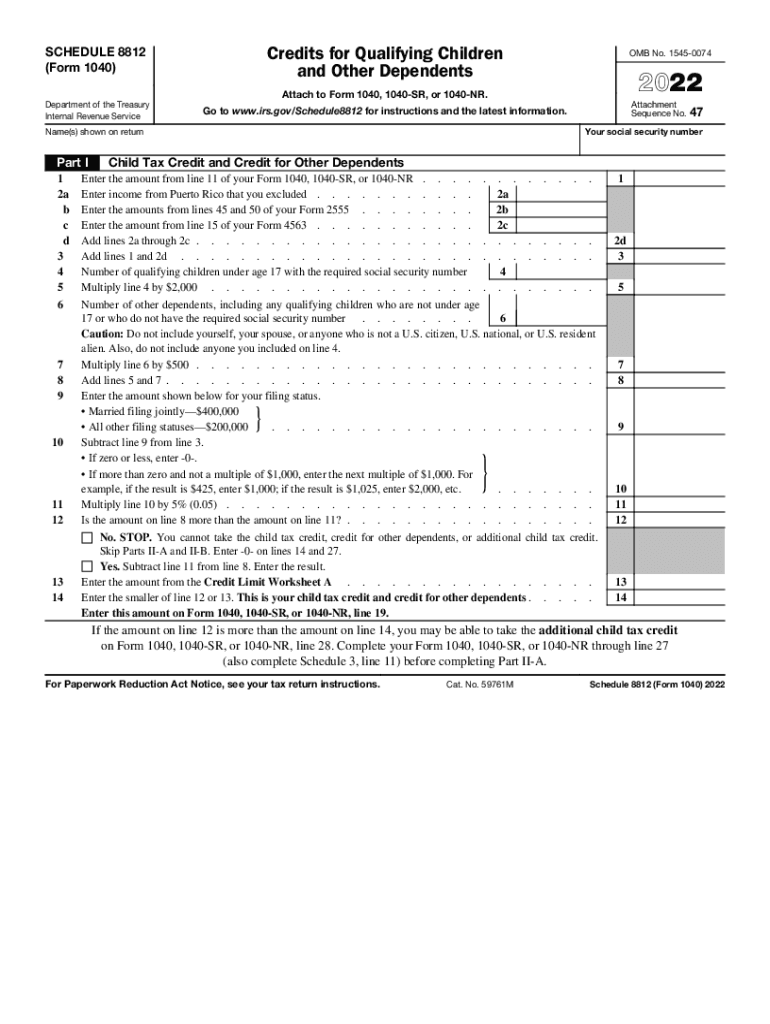

Source : www.taxdefensenetwork.comSchedule 8812: Fill out & sign online | DocHub

Source : www.dochub.comSchedule 8812 Instructions 2019 2024 Form Fill Out and Sign

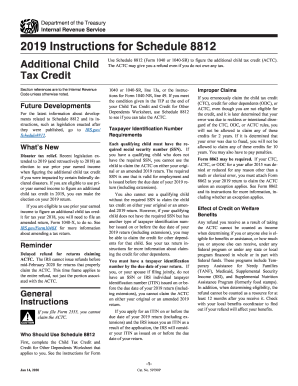

Source : www.signnow.comIRS 1040 Schedule 8812 Instructions 2021 2024 Fill and Sign

Source : www.uslegalforms.comMost Americans feel they pay too much in taxes, AP NORC poll finds

Source : suntci.com2011 2024 Form IRS 8812 Fill Online, Printable, Fillable, Blank

Source : irs-8812-fillable.pdffiller.com2024 Schedule 8812 What is the IRS Form 8812? TurboTax Tax Tips & Videos: The eligibilty limits for the Child Tax Credit are the same as last year but those taxpayers who wre eligible for the bumper payment in 2021 can still file. . If you owe less tax than the total of your CTC, you can use Schedule 8812 to claim up to $1,500 as a refundable credit through the Additional Child Tax Credit. • To qualify for the Child Tax .

]]>